pa tax payment forgiveness

Electronic Payment requirements for PA Personal Income Tax Article III payments. How do I pay back taxes in PA.

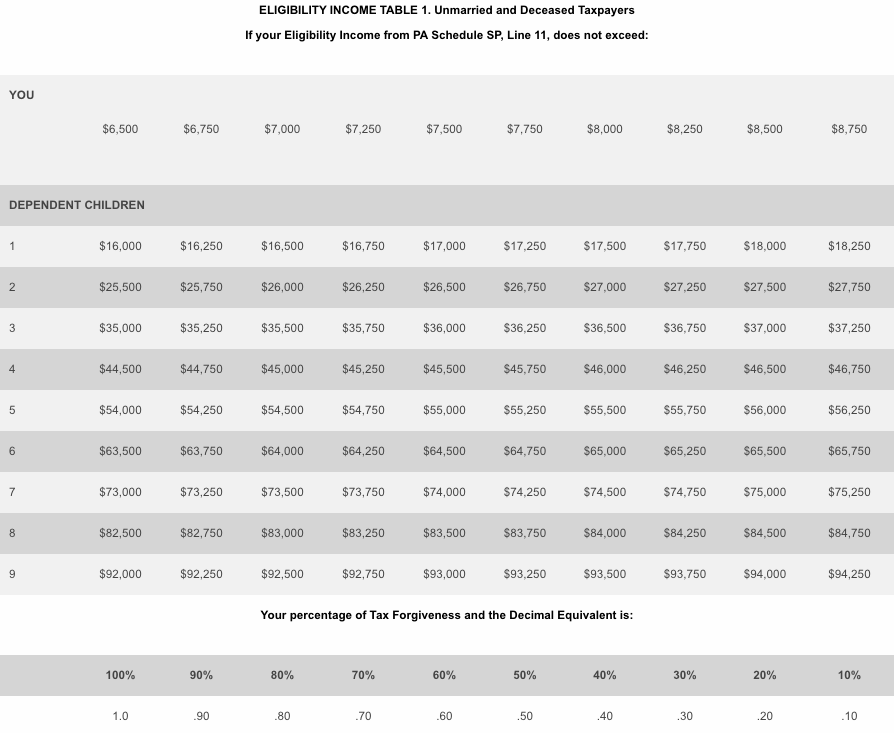

PA Schedule SP Eligibility Income Tables.

. At the bottom of that column is the percentage of Tax Forgiveness for which you qualify. The PA DOR refers to tax payment plans as Deferred Payment Plans. Different from and greater than taxable income.

The more dependent children you have and the less income you make the higher the percentage of tax forgiveness you will. According to the IRS the refundable tax credit is 50 or. If your Eligibility Income.

Tax Forgiveness is a credit against PA tax that allows eligible taxpayers to reduce all or part of their PA tax liability. Pa tax payment forgiveness Sunday May 15 2022 Edit. The Employee Retention Credit ERC under the CARES Act encourages businesses to keep employees on their payroll.

The departments instructions allow dependent children to claim tax forgiveness because as the 1974 law identifies the intent of the General Assembly as described above. Download PA Schedule SP. How do I pay back taxes.

However any alimony received will be used to calculate your PA Tax Forgiveness credit. Tips for Tax Forgiveness. Unmarried and Deceased Taxpayers.

The PICPA-supported PPP loan forgiveness provision was unanimously adopted by both the House and Senate and Gov. For more information visit the Internal Revenue Services at www. Review Comes With No Obligation.

Free Quote and Consultation. What is taxpayer forgiveness. A payment can be made by credit or debit card through ACI Payments Inc.

Ad Settle State IRS Taxes up to 95 Less. Instead taxpayers are instructed to call the DOR. Payments made for Article III liabilities which include individuals estates trusts.

Taxpayers may only claim dependents who are minor or adult children claimed as dependents on their federal income tax returns. Get Your Free Tax Review. Is there a one time tax forgiveness.

To receive Tax Forgiveness you must file a PA income tax return and complete PA Schedule SP. Individuals who wish to pay their tax debt by installments may do so through the DOR. Harrisburg PA With the personal income tax filing deadline approaching on May 17 2021 the Department of Revenue is reminding low-income.

The Pennsylvania Departments guidance is a welcome development for taxpayers looking to clarify the income tax treatment of various CARES Act relief payments. ELIGIBILITY INCOME TABLE 1. Taxpayers can apply for tax forgiveness by completing a PA Schedule SP along with their state personal income tax return.

What is a Pennsylvania tax forgiveness credit. Wolf signed Senate Bill 109 into law on Feb. Trusted Reliable Experts.

Go to the myPATH portal or via telephone at 1-800-2PAYTAX 1. Tax forgiveness is a credit that allows eligible taxpayers to reduce all or part of their Pennsylvania personal income tax. Alimony- Alimony payments that you received are not taxable in the state of Pennsylvania.

Yes the IRS does offers one time forgiveness also known as an offer in compromise the IRSs debt relief program. The DOR does not have a form that should be filed to establish a DPP. Taxpayers who qualify for PAs Tax Forgiveness program may also qualify for the federal Earned Income Tax Credit program.

To claim this credit it is necessary that a taxpayer file a PA-40. On Friday Feb. Philadelphia residents who qualify for PAs Tax Forgiveness program can get a partial refund of city wage tax withheld by their employer.

Depending on your income and family size you may qualify for a refund or reduction of your Pennsylvania income tax. To receive Tax Forgiveness a taxpayer must file a PA personal income tax return PA-40 and complete. It ranges from 0 to 100 in 10 increments.

The Pennsylvania Department of Revenue offers a DPP which is a payment plan for taxes. Or call the IRS toll-free 1-800-829-1040. 5 Pennsylvania Governor Tom Wolf signed PA Act 1 of 2021 a 912 million pandemic relief bill approved unanimously by the PA House and Senate.

Commonwealth Of Pennsylvania V Navient Corporation Et Al Commonwealth Corporate Pennsylvania

Pennsylvania Department Of Revenue Parevenue Twitter

Pa Municipality Tax Return Out Of State Credit For School Tax

Pennsylvania Tax Relief Information Larson Tax Relief

Pennsylvania Special Tax Forgiveness Credit Do You Qualify Supermoney

Pennsylvania Will Eliminate State Income Tax On Student Loan Forgiveness Phillyvoice

Pennsylvania S Property Tax Rent Rebate Program May Help Low Income Households Legal Aid Of Southeastern Pennsylvania

Cancelled Student Debt May Now Be Exempt From State Taxes In Pennsylvania Pennlive Com

Pennsylvania Department Of Revenue Parevenue Twitter

Doe Announcement In 2022 Public Service Loan Forgiveness Student Loans Student

Low Income Pennsylvanians May Be Missing Out On Pa Tax Refunds Of 100 Or More

L Earn Neuarmy Surplus Co Learn Earn Type Illustration Knowledge

Pa Budget Battle Is Covid Relief Money The Cure For Property Tax Rates Gop Says No Dems Say Yes Pittsburgh Post Gazette

Pennsylvania Department Of Revenue Parevenue Twitter

Pennsylvania S Property Tax Rent Rebate Program May Help Low Income Households Legal Aid Of Southeastern Pennsylvania

Pa Act 1 Of 2021 Pa Covid Relief Including Forgiven Ppp Loans Not Taxable Simon Lever